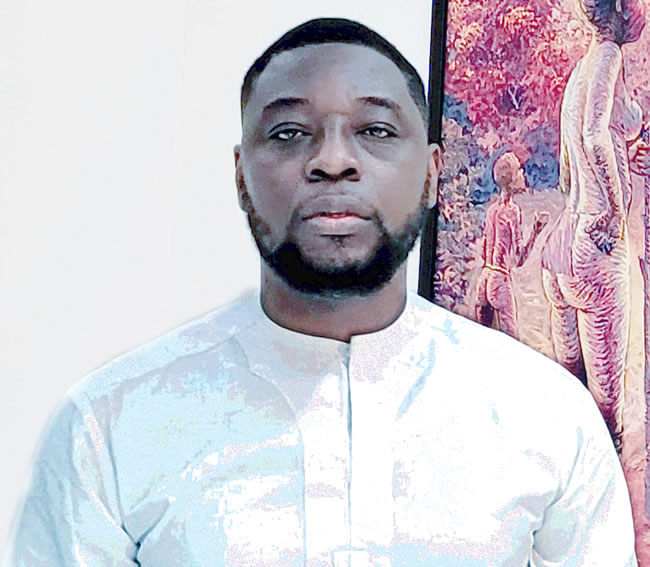

A Chieftain of the All Progressives Congress (APC) in Osun, Tele Oyegoke, has appealed to Nigerians, particularly those in Osun State, to support President Bola Tinubu’s new tax proposals.

Oyegoke, who is a hospitality entrepreneur and also the CEO of Bingo9ja, a lottery company, emphasized that the tax reform aims to alleviate poverty.

According to the Inisa-born politician, the new tax law is designed to bring relief to the small scale enterprises and most vulnerable members of society.

He urged citizens to cooperate with the government in implementing the tax reform, which is expected to generate more revenue for the country.

” The bill says that certain supplies will be exempt from the proposed VAT, including oil and gas exports, crude petroleum oil, and feed gas. Other exempt include: goods purchased for humanitarian projects, baby products, locally manufactured sanitary products, etc,” he clarified.

He also explained that, “Section 56 of the bill outlines tax rates to be imposed on the total profit of companies with small firm taxed at zero percent. All other companies will face a tax rate of 27.5 percent in 2025, from the current 30 percent, which will reduce to 25 percent from 2026. Citizens who earn less than N1 million in a year will also be exempted from tax payment.”

He further said, ” The Student Education Loan Fund will receive 25 percent in 2025 and 2026, 33 percent from 2027 to 2029 and 100 percent from 2030 onwards.”

Despite economic challenges faced by Nigerians, Oyegoke believes that the tax reform is necessary to bring about positive change and improve the lives of Nigerians.

“Nigerians should keep faith with President Bola Tinubu on his patriotic reforms. He has proven that he is capable of driving the country to economic freedom and financial prosperity. This can be confirmed from the increased in revenue available to all tiers of government since May 2023 that he came on board. Federal allocation to all states have increased tremendously. In Osun State, for instance, the budget projection for federal allocation in 2024 is N99.9 billion, but as of third quarter of the year ( end of September), the state had already made N153 billion. What this means is that by end of the year, the state would have got N180 billion to N190 billion,” he submitted.

The proposed tax reform bills, which were transmitted to the National Assembly by President Tinubu in October, include the Nigeria Revenue Service Establishment Bill, the Joint Revenue Board Establishment Bill, the Nigeria Tax Bill 2024, and the Tax Administration Bill.