• 27% of Lagosians yet to sight new banknotes

• Customers seek six-month extension of January 31 deadline

• CBN under pressure to extend old note demonetisation

• Fasua: Subject implementation to evaluation, adjustment

• Bankers making brisk business over lapses as VIPs mop up available volume

• Yusuf insists rigid implementation unnecessary

From poor logistics to trust issues and racketeering, efforts by the Central Bank of Nigeria (CBN) to continue with strict enforcement of the naira redesign policy have come under siege, findings by The Guardian have suggested.

The old notes are expected to be out of circulation, ceasing to be legal tenders in the next 20 days.

However, a survey conducted by The Guardian suggests 27.3 per cent of Lagos residents, Nigeria’s financial hub and headquarters of the Nigerian Security Printing and Minting Plc, are yet to see any of the new banknotes, much less receive one.

Of 176 respondents, 43.2 per cent called for a six-month extension of the window set for demonetisation of the old notes. Another 18.9 per cent asked for three months while 16.2 per cent were comfortable with a month extension.

Proponents of extension limits, such as a year and above, received the least percentage at 8.1 per cent while those demanding additional two months came next at 13.5 per cent.

The Senate had asked the apex bank to heed reason and move the deadline to the end of June, citing the hardship hasty enforcement would have on Nigerians.

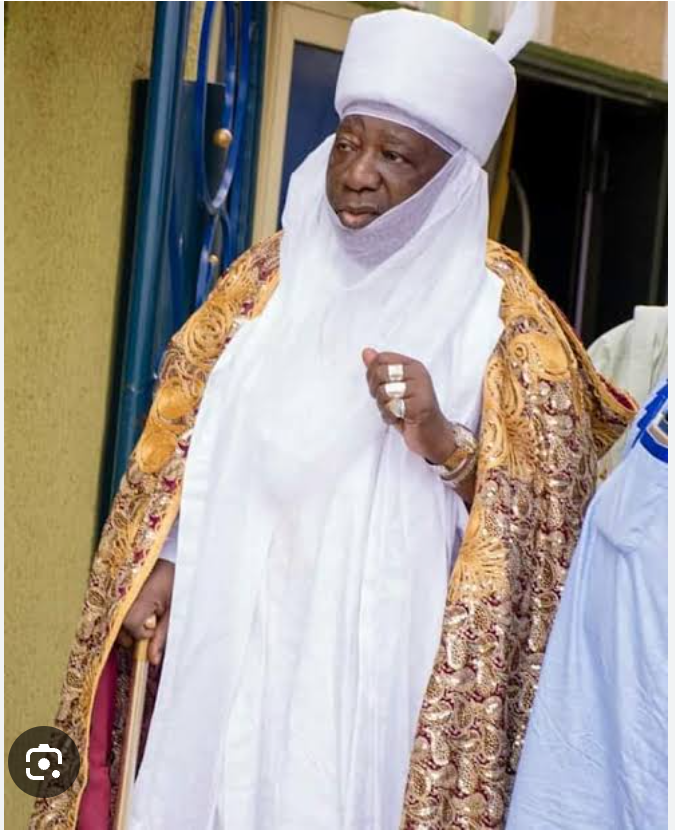

The upper legislative chamber’s resolution followed a motion titled, ‘Urgent need to extend withdrawal of old currency from circulation’, sponsored by former Senate Leader, Ali Ndume.

While the CBN said the currency redesign is aimed at checking counterfeiting, reducing the volume of money outside the banking system earlier estimated at N2.7 trillion, among others, some have suggested that the programme seeks to mop up black money and checkmate politicians ahead of the February and March general elections.

A few weeks after the policy was unveiled, The Guardian reported high net worth individuals, including politicians, were on Lagos and Abuja streets mopping up foreign currencies. But for the timely intervention of the Economic and Financial Crimes Commission (EFCC), the dollar had crossed the N850/$ psychological barrier and was heading to N1000/$.